Bitcoin which is the pioneer of the cryptocurrencies has closed December 31st 2018 at 3,689 USD price level. And the monthly opening price was declined by 13 per cent from 4,241 USD. This 5-month declining trend was the worst ever performance since November 2011 according to CoinDesk’s BPI (Bitcoin Price Index).

Will Bitcoin Rebound in 2019? The Bull vs Bear Case (Source: Bloomberg Markets and Finance)

Worst Ever Bitcoin Performance Since November 2011

In those days, BTC (Bitcoin) has been traded under 20 USD and has depreciated by 82 per cent in five months period until November 2011. We saw a bullish trend in the coming months and Bitcoin appreciated by 59 per cent in December 2011. This bullish trend continued until the 900 USD price levels which were seen in November 2013.

BTC (Bitcoin) has got the potential to repeat the historical trend as it has been oversold;

- 52% loss in the last five months.

- 70% loss during the year 2018.

- 80% loss from the highest ever (in December 2017) price level of $19,783.

There may be a dynamism loss due to the bearish trend. NVT (Network Value Transmitted) ratio is at 108 levels, and this is a sure sign of oversold for BTC.

Additionally, a long-term bullish reversal confirmation will be confirmed at the price level higher than $5,547 which is the 21-month EMA (Exponential Moving Average).

During my posting, BTC (Bitcoin) price is $3,894 according to CoinMarketCap data (1.63% higher than the previous 24 hours).

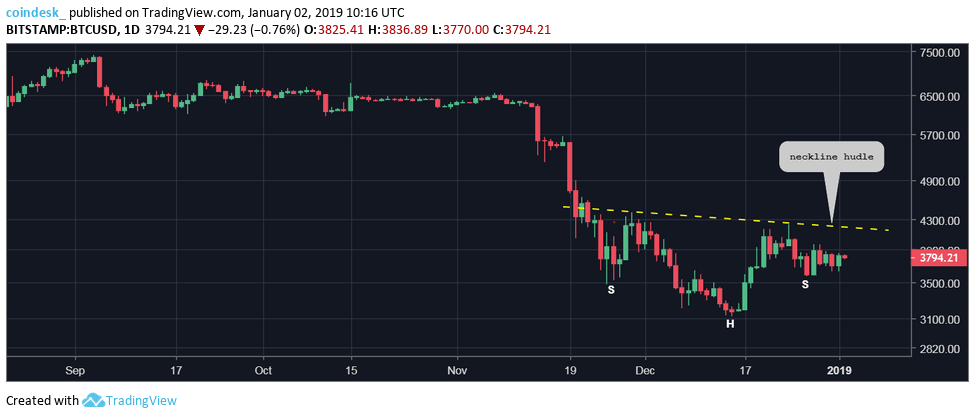

BTC/USD Daily Graph

BTC generally shows an increasing trend in inverse head-and-shoulders formations. If we analyse the daily graph above, we see a neckline resistance value at $4,180.

Closings above $4,180 price level may lead to a bullish trend towards $5,200.

We even may test $4,180 price level in the short-term if a bullish trend can be seen on the 3-Day graph.

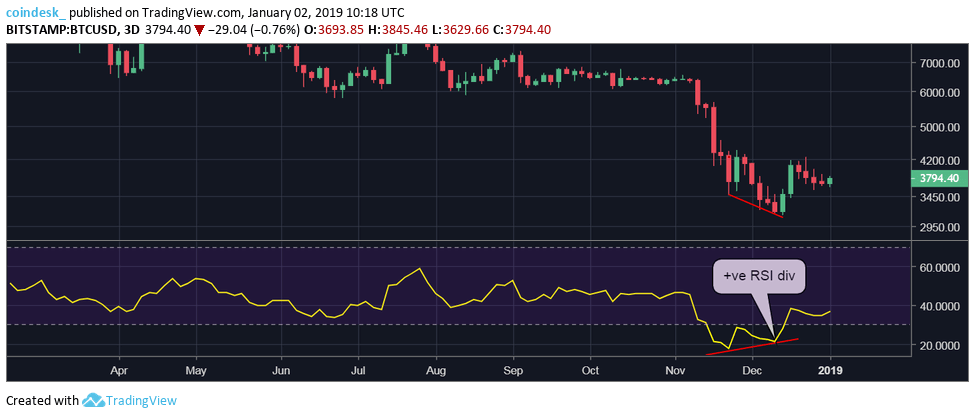

BTC/USD 3-Day Graph

If we refer to the above graph, we can see that Bitcoin has tested the lower than $3,122 price levels. For this reason, the mid-December bullish outlook due to positive diversity of RSI (Relative Strength Index) is still acceptable.

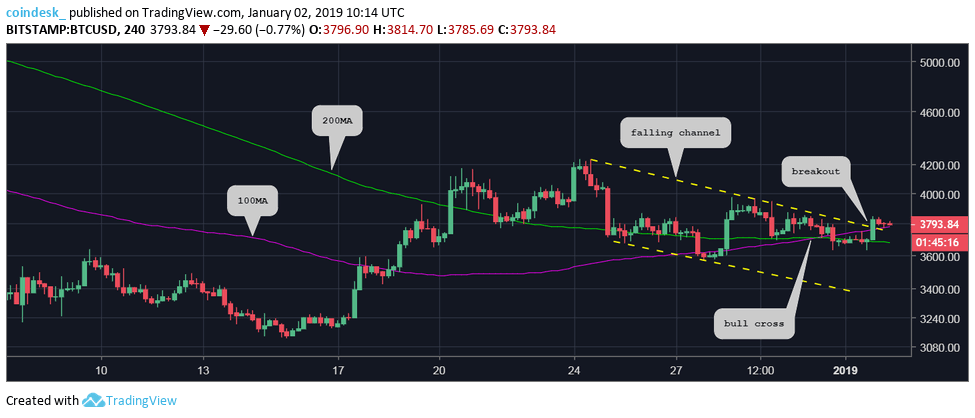

BTC/USD 4-Hour Graph

In the above 4-Hour graph, 100 candle-stick MA (Moving Average) is observed just by 200 MA (Moving Average). This formation is an indicator of the higher path with least resistance.

The graph also indicates that there is a termination on the declining channel which means a bullish formation. For this reason, Bitcoin may test higher levels of $4,200.

Possibilities

- BTC (Bitcoin) may stop its 5-month series of losses in January 2019.

- A confirmation on the ending of inverse head-and-shoulders formation may lead to acceptance of 3-Day RSI’s bullish disparity and 5,000 USD price level can be tested in the short-term.

- BTC’s positive January expectations may become a dream if we see lower than 3.566 USD price levels which is the lowest level realised in December 27th 2018.