The company gives so many benefits like high leverage, fewer fees, low spread, etc. Hence, this online trading brokerage company has the highest rating in Australia.

Also, these trading broker companies provide investment solutions to clients. Only investment banks and wealthy individuals gave investments to retail clients. So, to cope with this, the IC Markets bring the most effective investment solutions and, ultimately, the need to stand in long queues. Moreover, they help the clients to trade using FX trading after looking out their commodities, upcoming plans, and other indications.

IC Markets – Supervision & Reputation

As mentioned earlier, the Australian Securities & Investments Commission (ASIC) supervises the functionality of the IC Markets. The ASIC regulatory agency makes sure that the company abides by all the laws and guidelines laid by them. The company has issued the license 335692 to operate the online trading brokerage in 2009. Undoubtedly, the IC Markets has got a well-built name in the Forex brokerage markets. The company has a good reputation, which enhances its credibility in the market.

Furthermore, IC Markets is a part of the Financial Ombudsman Service (FOS). It enables the traders to avail of the best customer services and gets the solutions to their queries instantly. These professional customer services help the clients to feel like they are in safe hands.

Along with FOS, the online trading brokerage is True ECN Trading Ltd and controlled by FSA in Seychelles. Furthermore, European traders also have access to IC Markets. These are under the regulation of CySec. Recently, the company has started to abide by the leverage restrictions of ESMA.

The organization given above ensures getting effortless, quick, and reliable services. The customers have the guarantee that the brand they are choosing is looked over by authentic organizations.

Types of Trading Accounts

Something that stands IC Markets out is the alternatives it brings for its clients. There are three different trading individual accounts which the company offers to the traders, namely:

• True ECN

• Standard

• cTrader ECN

Among these, a True ECN account has lower spreads comparatively. Also, if someone does not know how to trade using the accounts mentioned above, IC Markets let them watch a free live demo account for better understanding. The demo enables the trader to perform trading using virtual money but in the real market.

Trading Platforms

Another point that makes the IC Markets famous among traders is that they give the traders with three different trading platforms. The traders have a choice to pick any trading platforms fitting their choice. These high-quality trading channels get some of the best features, tools, and ways, enabling safe trading for the clients.,

Find out some of the best available trading platforms below:

MetaTrader4 Trading Platform

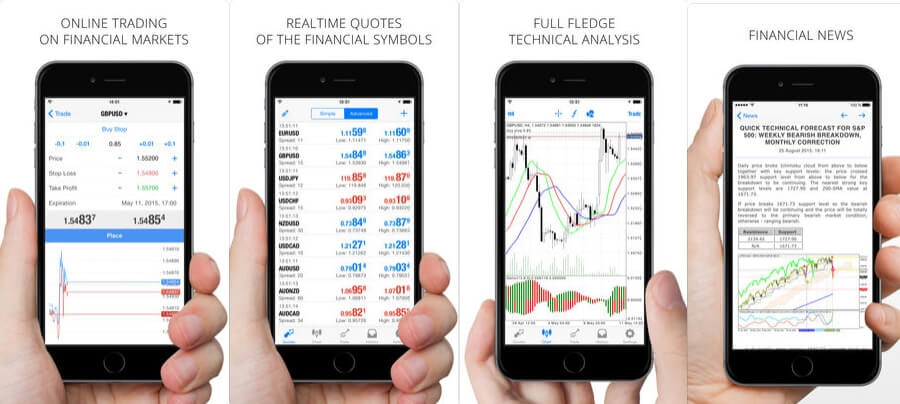

MetaTrader 4 is one of the most popular trading platforms present online. The traders can trade on this platform just by a single click. Also, for an in-depth analysis, MetaTrader 4 allows clients to make changes according to their choice and requirements. Additionally, the platform comes with a wide range of options like technical indicators, charts, back-testing options, and advice from experts for ease. One can begin trading on this platform using mobiles and desktops within seconds.

MetaTrader5 Trading Platform

MetaTrader5 is a new type of MetaTrader trading platform. As compared to MetaTrader4, it is a better and more convenient version with advanced features and enhanced tools.

CTrader

CTrader is specifically for ECN accounts. The platform is an automated version. Moreover, for trading, the clients can further choose from ZuluTrade, Myfxbook’s AutoTrade, and Signal Trade. It is also available both on mobiles and desktops.

Deposits & Withdrawals

Depositing Funds:

The online trading brokerage allows depositing via Credit/ Debit Cards, Bank Wire Transfers, PayPal, Skrill, Neteller, WebMoney, QIWI, China Union Pay, FasaPay, etc. Also, with IC Markets, the clients can deposit quickly with a variety of up to ten different currencies, i.e., SGD, USD, EUR, AUD, GBP, CAD, NZD, JPY, CHF, HKD, and HKD.

Withdrawing Funds:

One can withdraw their transfer funds nationally without waiting for long and spending a single penny. It is the case for transfer from bank to bank and online transfers as well, although fees for withdrawing an international fund is $25 while the time taken will be around 3-5 working days.

Promotions and Bonuses

The traders are more likely to choose platforms that give bonuses to their traders. But, the IC Markets does not bring any such offers for the clients. Some even consider this a lagging point; however, the quality and the popularity of IC Markets is a reality. Trading on a stable platform is a way better and reliable option than having incentives on a common platform.

IC Markets Trading Assets

Well, the IC Markets FX trading broker brings enough trading assets for the clients. The traders can get more than 80 trading instruments like Stocks, Precious Metals, Cryptocurrencies, CFDs, Multi-currency, etc.

Top Features

More than 90 currency pairs are available for the best possible trading experience. Other features include up to 500:1 leverage, 0.01-1 lot size, etc. On cTrader, the traders can lessen the spreads to 0.0. The minimum amounts of spreads are as low as 0.1 pips for EUR/USD. The site offers benefits like less commission and spread costs for loyal traders.

Trading Hours

The IC Market depends upon the trading markets. So the trading brokerage works when the global markets do. However, as far as the working hours are concerned, the IC Markets offer 24 hours of unlimited trading service per day, five trading days a week.

Customer Service

The IC Markets has an excellent customer service that is available 24 hours a day and five days a week in multiple languages. Also, the clients can clear FAQ’s using live chats, email, and contact number. Along with this, the platform has an educational support center for users with answers to frequently asked questions.

Accepted and Restricted Countries

The IC Markets accept most of the countries for trading including Australia, Thailand, the United Kingdom, Germany, Norway, Sweden, Hong Kong, Denmark, United Arab Emirates, Saudi Arabia, Kuwait, South Africa, Singapore, Luxembourg, India, France, Italy, Qatar, etc.

However, traders from the United States, Cuba, Liberia, Canada, Zimbabwe, Iran, Ghana, Cote D’Ivoire, Iraq, Togo, and Nigeria cannot trade on IC Markets.

Is IC Markets Good for Day Trading?

Many factors make IC Markets the best for Day Trading, for instance:

Less amount Spreads: Lower costs of trading are high. Hence, the minimum spread of 0.1 on EUR/USD will reduce trading costs. IC Markets allow high-frequency trading with less commission and trading costs on the gains.

Educations of traders: As the platform provides live demos, articles, and guides to begin with trading. Thus, these assist traders in every aspect of day trading.

Tools: IC Markets brings the best tools, technical indicators, charts, calculators for the traders.

Assets: There are sufficient asset categories available on the platform. Hence, the new day traders can make use of these codes to initiate the best trading experience.

Conclusion

To sum up, IC Markets is one of the best recommendations for happy and safe trading practices. They include all the features the traders look for trading. So, begin trading with the brokerage. Make sure to start with a free demo account.

FAQ:

Are the IC Markets regulated?

As discussed above, the regulation of IC Markets is under the Australian Securities and Investments Commission (ASIC). In addition to that, the Cyprus Securities, Exchange Commission, the Financial Services Authority (FSA) also govern the company. It is why the clients trust the IC Markets.

Where are the IC Markets located?

The company is located in Level 4 50 Carrington Street, Sydney NSW, 2000 AUSTRALIA.

How do IC Markets earn?

The online Forex trading broker earns from the spreads, swaps, and few commissions in the trading platforms and instruments.